Quick payroll calculator

For starters heres a quick rundown on federal payroll taxes. You can file unlimited 1099s including 1099-NEC and 1099-MISC 2.

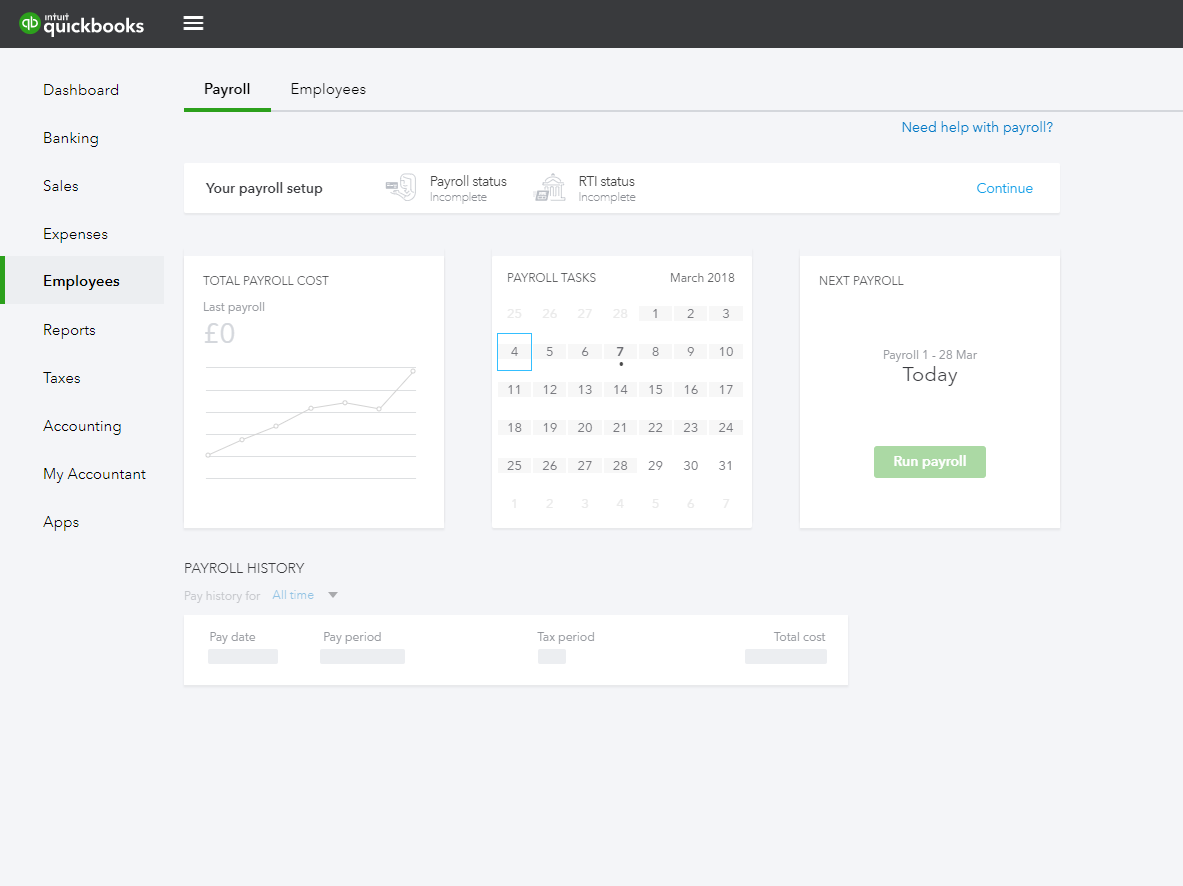

Gusto Vs Quickbooks Payroll Compare Pricing Product Features And More Gusto

QuickBooks offers 1099 e-filing services with QuickBooks Payroll 1 and QuickBooks Contractor Payments.

. Exempt means the employee does not receive overtime pay. Federal Payroll Taxes. If you would like to see a more detailed explanation we invite you to head on over to our comprehensive step-by-step guide.

SAP Payroll - Quick Guide SAP Payroll is one of the key modules in SAP Human Capital Management. First and foremost we have to give Uncle Sam his due. Apart from this there is one more type of claim known as the slab based claim.

Your Payroll Month and Year. See Washington tax rates. This is used to calculate the remuneration for each employee with respect to the work per.

As part of the Total Rewards Operations Center team in Human Resources Payroll is available to process paychecks taxes and direct deposit forms and help with all other payroll processes. We do this through our expert knowledge and broad experience operating in. Then enter the employees gross salary amount.

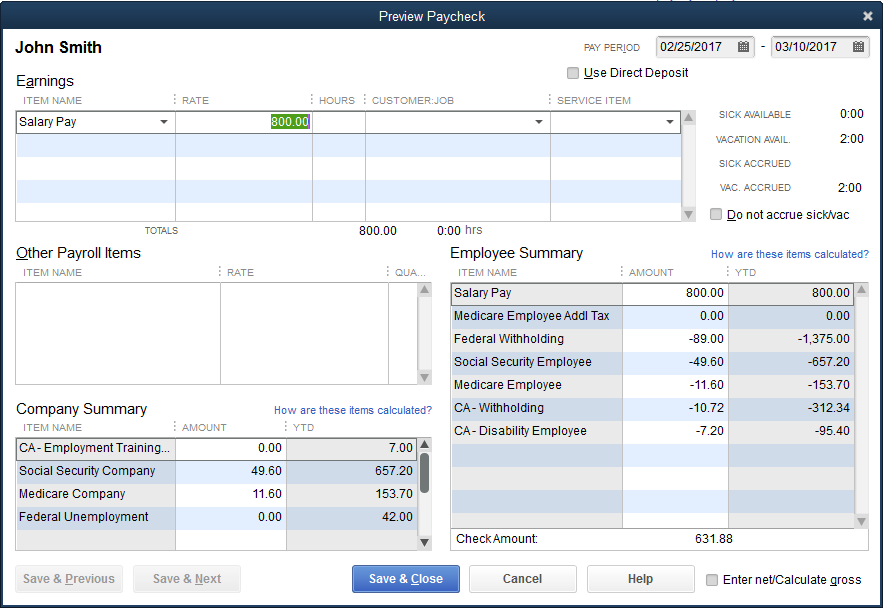

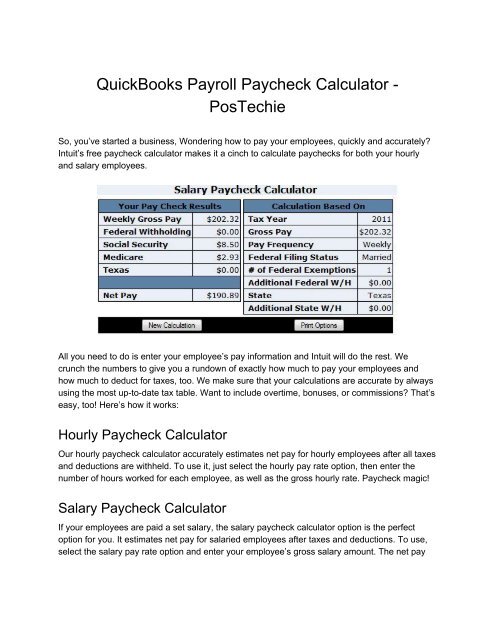

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. Our mission is to de-risk contracting for you and your end clients. When you use QuickBooks Payroll or Contractor Payments your 1099s will be automatically generated and e-filed for you saving your time and helping you prepare for tax season.

For many years Access Financial has provided support in outsourced contractor payroll and other back-office services. A few common types of slab based claims are LTA. Well go through a quick overview of what you need to know when it comes to calculating federal payroll taxes.

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. PR Date DDMMYYYY CPF Donation Type. Whether youre paying them hourly on a salary or by another method.

The Central Provident Fund CPF is an employment-based scheme that acts as a mandatory savings plan for Singaporeans and Permanent Residents PR. Our free CPF Calculator shows your contribution for each every donation type. Before you can start the journey of calculating payroll taxes you first have to figure out how youre rewarding your employees for their time ie.

How To Calculate Payroll Taxes Methods Examples More

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

Payroll Paycheck Calculator Wave

Pay A Partial Or Prorated Salary Amount In Quickbooks Desktop Payroll

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

Manually Enter Payroll Paychecks In Quickbooks Online

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

One Day Processing Now Available For Quickbooks Payroll

Connect Quickbooks Payroll Hr Benefits With Quickbooks Online Intuit

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

How To Calculate Payroll Here S A Quick And Smart Method Timecamp

Toast Payroll Manual Checks And Quick Calcs

Quickbooks Paycheck Calculator Intuit Paycheck Calculator

Square Payroll Vs Quickbooks Payroll Which Is Best Why

65 Best Payroll Services For Your Businesses Housecall Pro